mHealth App Publisher Segmentation: The 6 Groups That Will Shape The mHealth App Market In The Near Future

mHealth app publishers are grouped into 6 distinct segments. Segments differ mainly by goals, business approaches and performance. Their desire to help others distinguishes them from the rest of the app community. Knowing these segments is a pre-requisite for all those who wish to successfully participate in the new mHealth app ecosystem.

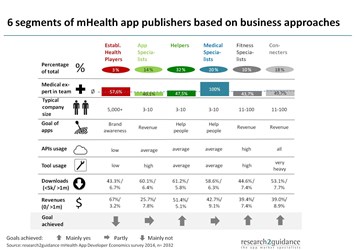

Who is behind the 100,000 mHealth apps published in recently app stores? How do the publishers differ in terms of motivation, development tool usage and satisfaction about goals achieved? The mHealth app publisher segmentation distinguishes 6 groups of current mHealth app publishers. This segmentation is based on the results of the mHealth App Developer Economics 2014 study.

A deeper knowledge about the mHealth app publishers is essential to all health market participants who wish to successfully navigate inside the newly emerging mHealth app ecosystem.

mHealth app publishers are not like game or tool app developers. 46% publish apps, because they want to help others. They also have objectives like revenue generation or raising brand awareness, but this “altruistic” attitude clearly distinguishes them from the rest of the app economy.

Within the six mHealth app companies, publishers with a strong medical background and those who leverage existing app development tools & APIs seem to accomplish their goals better than those who do that to a lesser extent.

Traditional healthcare players like Pharma, Med-tech or insurance companies have not been able to define their role in the market yet. Established Healthcare Players are the only segment “mainly not” satisfied with their goal achievement.

These are the profiles of the 6 distinct mHealth app publisher segments:

- Established healthcare players: This group includes Pharma, hospitals, health insurance and Med-tech companies, representing 3.4% of the total number of app publishers. These players usually belong to the mHealth app publishers with > 5,000 employees. Their primary objective for being in the market is to raise brand awareness and they have published the largest number of mHealth apps. Nevertheless, average reach in terms of downloads is far below the market’s average. App publishers in this group are so far the least satisfied with the achievements in the mHealth app market. The usage of tools and APIs to improve the efficiency of the app development process and app monitoring as well as the value of the app is below its competitors.

- App specialists: App specialists are small companies, which typically hire 3-10 employees. They have entered the mHealth app market in order to benefit from its potential. They have an app developer background and are familiar with available development and support tools. The share of medical experts on board is relatively low. This group constitutes 14% of the mHealth app publisher community.

- Helpers: Helpers’ primary motivation for publishing apps is to help others and they are usually organized into small companies of 3-10 employees. Revenue generation is only a minor factor. Typically Helpers have already achieved or over-achieved their goals. In terms of downloads, they have the highest share of companies (61%) that achieved less than 5,000 downloads last year. Helpers represent 32% of the market.

- Medical specialists: Medical specialists leverage their medical know-how to develop mobile apps. Similar to the Helper group, Medical specialist have a large share of members who publish apps to help others. By far they have partly reached their goals. They have the highest share of companies, which in 2013 earned more than USD 1m with their mHealth app portfolio. They represent 20% of the market.

- Fitness specialists: This group of app developers represents around 10% of the total mHealth app developer community. They primarily develop fitness apps with a clear objective to generate revenue. They connect more often to medical databases and sensors and use app development tools above average. The usual company size is 11-100 employees.

- Connecters: This group of mHealth app publishers represents 18% of the total mHealth app developer community. Their strategy is to create value rich apps by enabling connection to other apps, sensors and databases. This group generates the highest average revenue and has the highest goal achievement level.

The mHealth app publisher segmentation is a snapshot of the current state of the market. It will change as segments become more important (medical specialists) or new groups appear. One of the main questions will be if and how traditional healthcare players will be able to compete with these small and agile companies that are driving the market today.

For more information, visit http://mhealtheconomics.com/mhealth-developer-economics-report/.

Source: mHealth app